Omnis Market Update Q1 2020

Posted by Andrew_Smith on Monday 6th of April 2020.

By a number of measures, the first quarter of 2020 was the worst for equity investors since the aftermath of the Black Monday stock market crash in 1987. As coronavirus spread around the globe, and as the economic implications of efforts to contain its spread became clear, the eleven-year bull market in global equities came to a halt. Stock market indices across Asia, Europe and the US fell in unison, with the UK’s FTSE All Share index falling close to 35% from its peak.

Some – including us (see ‘Shades of 2008’) – have compared recent weeks to the financial crisis of 2008. In early March, these comparisons were justified by signs that the very structure of the global financial system was once more under threat. However, decisive action from central banks, led by the US Federal Reserve, appear to have mitigated this risk, ultimately paving the way for a partial recovery in stock markets towards the end of the quarter.

The current crisis is differentiated from 2008 not just by the reaction it has elicited from policymakers, but also by its cause. Whereas the financial crisis was precipitated by the bursting of a bubble in the market for US real estate, the coronavirus is a truly exogenous shock – one delivered from outside the realm of the global economy or its financial system. As a result, it’s arrival was all but impossible to forecast.

A further difference to 2008 – and to the vast majority of other periods of major market turbulence – is the pace at which recent events have unfolded. We now know that, at the onset of the financial crisis, the US economy entered recession in December 2007. However, this was not confirmed until December 2008, by which time Lehman Brothers had gone bust and the US stock market had fallen some 45% from its peak. Fast forward to 2020 and there can be little doubt that the global economy entered recession in March, an event few were predicting as recently as February.

The reaction in stock markets has been severe, with US equities falling 20% in just 21 days. By way of comparison, it took twice as long for the market to fall 20% at the onset of the Great Depression in 1929, and thirteen times as long in the financial crisis. Given the very real threat posed by the virus, and given the vast economic impact of efforts to limit that risk, the market response is perhaps understandable to some extent. However, we believe it has resulted in an opportunity for investors willing and able to retain their focus on the medium-to-long term (see ‘Focus on the Horizon’)

As traumatic as the coronavirus outbreak remains, there are tentative signs that efforts to contain its spread are working. Coupled with an unprecedented level of support from global monetary and fiscal policymakers (see

‘The Outlook is Improving’), there are reasonable grounds to hope that the crisis may prove relatively short- lived, and that the global economy can quickly recover (see ‘There is a Way Out of This’). We believe current stock market valuations do not reflect the potential for this scenario to unfold.

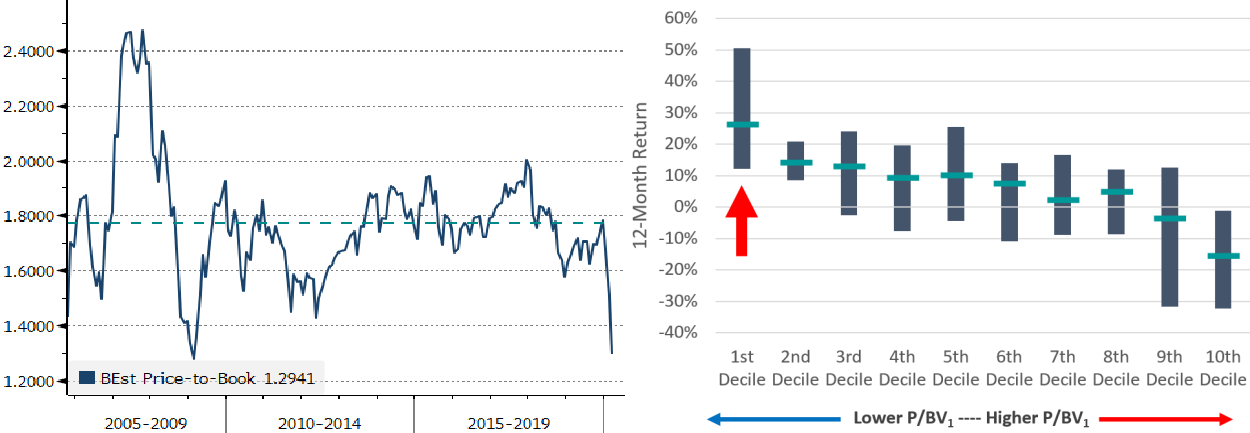

By way of example, consider the UK equity market. As measured by the price-to-book value ratio (a measure of value which compares a company’s share price to the value of its assets, for example its factories, equipment and inventories) the FTSE 100 index has seldom been more lowly valued. If we rank past price-to-book value ratios for the index from lowest to highest, we can see that the current ratio is among the lowest 10% on record. Historically, the twelve-month returns associated with buying UK equities at this level have been very strong (see Figure 1).

Figure 1: The price-to-book value ratio for the FTSE 100 has seldom been lower (left). Historically, buying at these levels has yielded strong gains over the subsequent twelve months (right)

In summary, the World has a difficult few months to navigate where the headlines regarding the virus and the economic impact will look scary! As long-term investors we must look through this and keep focused on the fact that this event will pass. Many Nations have taken unprecedented social steps to restrict freedom of movement, but as China and South Korea show, this does bring the virus under control to the extent that people can return to work. When this is the case for other nations that are currently in a locked down state, markets will start to behave more normally. As with previous crises, investors will look back at a buying opportunity that presented itself based on a valuation of assets that used imperfect information at the time. Remaining invested and maintaining a diversified portfolio of assets in line with your attitude to risk and personal circumstances, we believe, is the best way to get through periods such as now.

Stay safe and stay home (for now).

Please note: by clicking this link you will be moving to a new website. We give no endorsement and accept no responsibility for the accuracy or content of any sites linked to from this site.