Estate Administration

element of the process. This means dealing with all their assets (such as property, shares and

personal possessions), paying debts and paying any Inheritance Tax and Income Tax. Whatever is left

in the estate is then transferred to the beneficiaries. Estate administration can be extremely

complex and is required after every death, whether or not there is a Will.

carried out, including:

and it leaves them personally liable for any mistakes made during the process.

rarely straightforward. That’s why Seneca Reid has partnered with Kings Court Trust,

our preferred provider of estate administration, to deliver an estate administration service.

especially at a time when financial matters are the last thing on our minds. Kings Court Trust is

one of the leading specialist estate administration service providers in the UK and, like us, they

place their clients at the very heart of everything they do.

Openwork Limited accept no responsibility for this aspect of our business. This service is not

DIY Probate is a free online information service

This website can provide you with support to understand what to do when someone dies.

Taking care of the tasks following the death of someone isn’t something you will face on a regular basis and knowing where to start can be daunting. DIY Probate is a free online information service which has been created to help you understand what needs to happen after someone dies.

DIY Probate is powered by Kings Court Trust and it covers the following topics:

• The funeral

• Death certificate and Coroner's Inquest

• Personal Representatives

• Estate administration

• What to do when someone dies

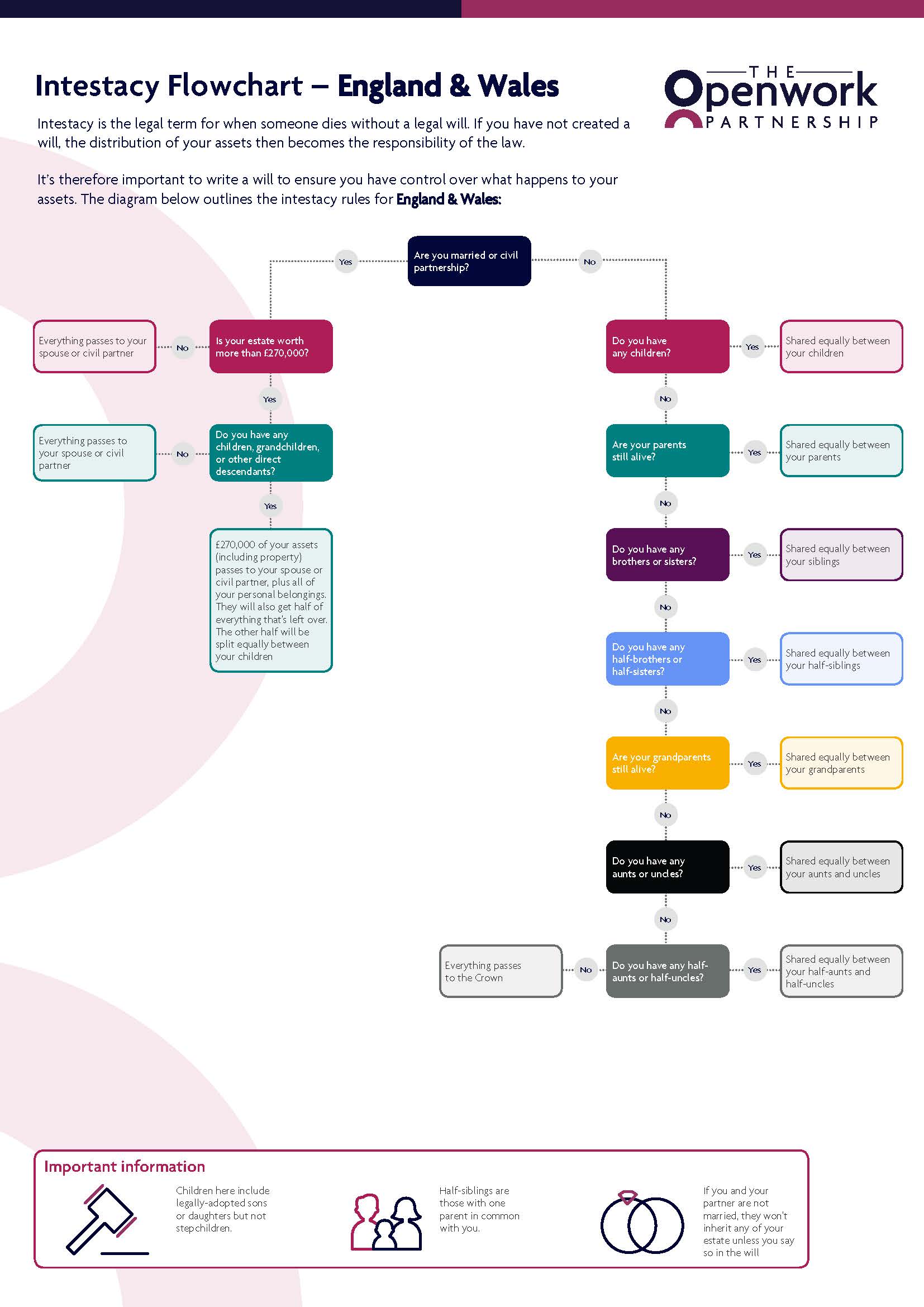

• Intestacy (when there is no Will)

• Planning ahead

• Money and tax

• Probate and legal

• Registering a death and informing others

• The responsibilities of an Executor

• Writing a Will